Learn about how your retirement contributions are affected in 2025

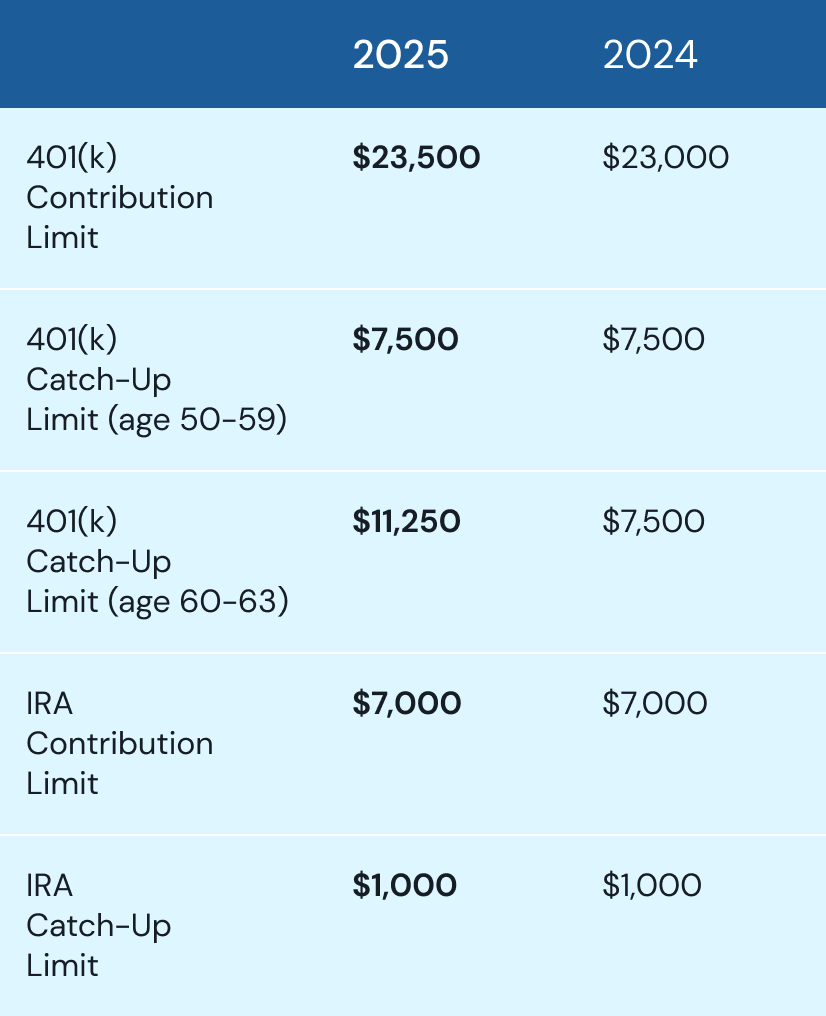

The year 2025 will see an increase in 401(k) contribution limits while IRA contribution limits remain unchanged. The contribution limit for employees who participate in 401(k), 403(b), most 457 plans, and the federal government's Thrift Savings Plan will increase to $23,500, up from $23,000. The limit on IRA annual contributions remains at $7,000.1

In addition to these changes, the catch-up contribution limit for 401(k), 403(b), most 457 plans, and the federal government’s Thrift Savings Plan for employees ages 50-59, remains at $7,500 for 2025. New for 2025, based on changes made under the SECURE Act 2.0, a higher catch-up limit of $11,250 now applies to employees ages 60-63 who participate in these plans. The IRA catch-up contribution limit for individuals aged 50 and over remains unchanged at $1,000.2

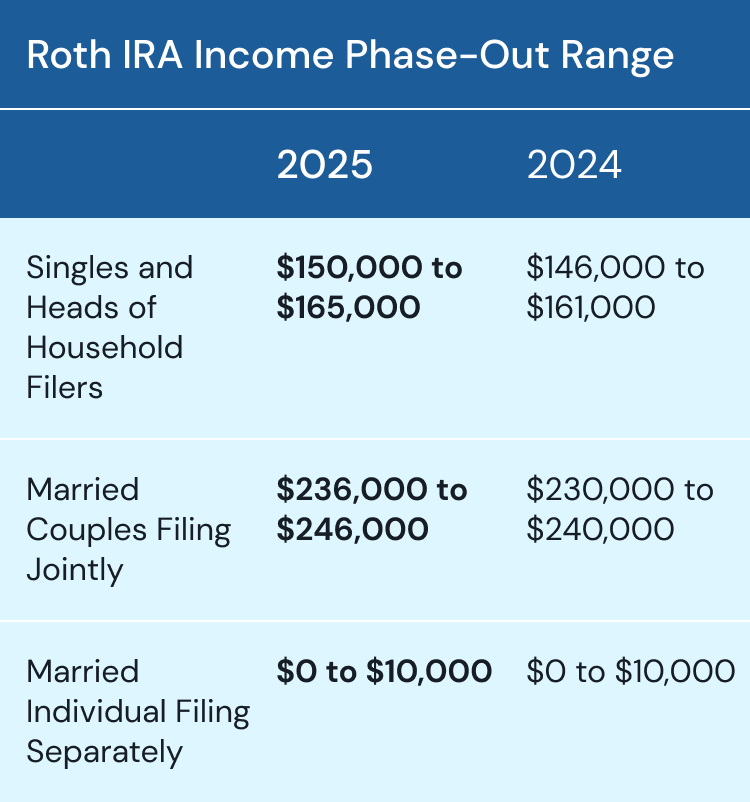

Another key change this coming year is an increase to the Roth phase-out cap: The income phase-out range for taxpayers making contributions to a Roth IRA will increase to $150,000 and $165,000 for single filers and heads of households; up from $146,000 and $161,000. And for married couples filing jointly, the income phase-out range increases to between $236,000 and $246,000, up from $230,000 and $240,000. For married individuals filing separately, who is covered by a workplace plan, their income phase-out remains the same from last year at $0 and $10,000.3

The Saver’s Credit (Retirement Savings Contributions Credit) income limit was increased for all filing groups. Married couples filing jointly increased to $79,000, up from $76,500. Head of household went up from $57,375 in 2024 to $59,250 and married individuals filing separately went up to $39,500 from $38,250.4

For more information, read class “How Your Retirement Savings Are Taxed.”

SOURCES

-

“401(k) limit increases to $23,500 for 2025, IRA limit remains $7,000.” IRS.gov, 1 November 2024, https://www.irs.gov/newsroom/401k-limit-increases-to-23500-for-2025-ira-limit-remains-7000. Accessed 1 November 2024.