Last Updated: December 30, 2024

When it comes to enrolling in Medicare or changing your plan, timing is key. If you’re already collecting Social Security, you will automatically be enrolled in Medicare Part A and Part B. Alternatively, there are six enrollment periods with different dates. But first, here’s an overview of the enrollment periods to help you determine which dates to mark on your calendar.

If it’s your first time enrolling in Medicare, here are your three enrollment options:

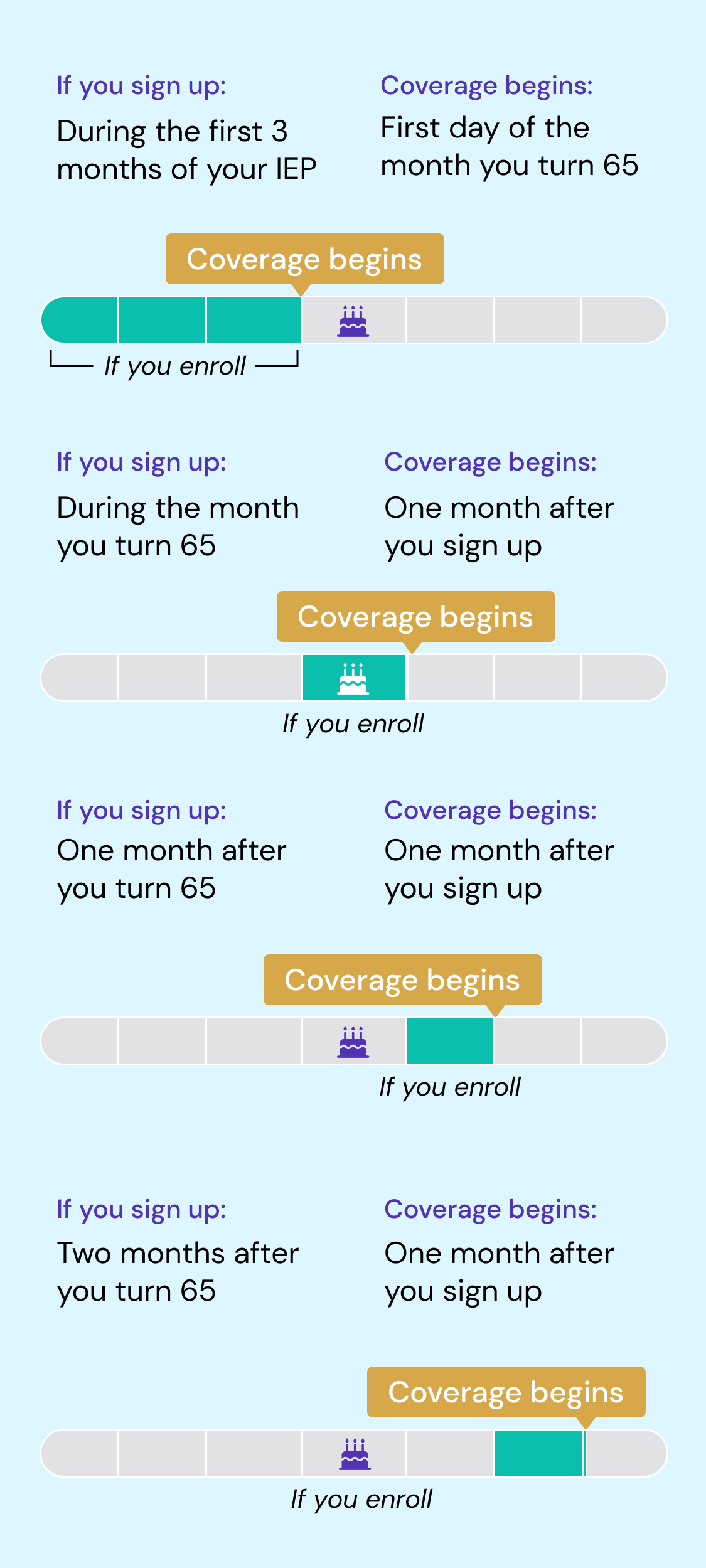

Initial Enrollment Period (IEP). This is the seven-month window when first-time enrollees can sign up for Medicare. Your individual IEP starts three months before you turn 65, and lasts for three months after the end of your month of birth. For example, if your 65th birthday is October 20, your IEP starts July 1 and ends January 31. During the IEP, you will choose whether to enroll in Part A and/or B, a prescription drug plan or a Medicare Advantage plan. The start of your coverage depends on when you enroll:

Special Enrollment Period (SEP). Sometimes, you’ll have extenuating circumstances and need to change your coverage, such as a move or losing insurance through an employer. In those cases, you may qualify for an SEP, which allows you to enroll or make changes to Original Medicare, Medicare Advantage or prescription drug coverage outside of the regular enrollment periods. You can enroll within two months after your special event occurred. Keep in mind that there are rules on what changes you can make and when you can make them.1

Medigap Open Enrollment Period. If you find that Original Medicare coverage doesn’t fully fit your needs, you can purchase a Medigap policy to help cover additional costs. Medigap can help cover things like deductibles and coinsurance payments that can quickly cause your medical expenses to skyrocket.

You’re entitled to a six-month enrollment period that starts the first day of the month you turn 65, and you’ll need to be signed up for Medicare Part B in order to qualify. You can enroll in any Medigap policy sold within your state, even if you have health issues. Although you can purchase Medigap after the enrollment period ends, companies can adjust your premiums or deny you coverage based on your health.

If you’re already enrolled in Medicare, here are your three enrollment periods:

Annual Enrollment Period (AEP). Held once a year between October 15 and December 7, AEP, or open enrollment, is when anyone can make changes to their coverage, switch to a different plan, or enroll in a Medicare plan. All changes made during this time take effect January 1. If you miss AEP, you may be able to make changes during the Medicare Advantage Open Enrollment Period or General Enrollment Period. We’ll cover both below. Depending on your situation, you might also qualify for a Special Enrollment Period.

General Enrollment Period (GEP). If you missed signing up for Part A and/or Part B during your IEP, you can do so during this three-month window (January 1 to March 31). Your coverage starts the month after you sign up.

Medicare Advantage Open Enrollment Period (MAOEP). If you have a Medicare Advantage plan and want to switch to a different plan or Original Medicare, this is your chance to make a one-time plan change. MAOEP runs from January 1 to March 31 every year. Coverage begins the first day of the month after your new plan receives your request for coverage.

Thinking about Delaying Enrollment?

Generally speaking, unless you have another source of qualifying coverage, you must sign up for Medicare when you turn 65 or face late-enrollment penalties. Those surcharges can be steep: your monthly premium can increase by 10% for each year-long period you were eligible but didn’t sign up. Your partners at Silvur Insurance can help you understand the penalties for delaying enrollment if you don’t have another source of qualifying coverage.

More often than not, you’ll have to pay this penalty every time you pay your premiums, for as long as you have Part B, and it increases the longer you go without that coverage.

Still Working When You’re Eligible for Medicare?

You can enroll in Part A when you turn 65 even if you’re covered under an employer-sponsored plan, but may not want to if you are contributing to an HSA. Part A is free if you’ve worked the required number of quarters. However, you may be able to delay enrolling in Part B if you’re eligible for a Special Enrollment Period. But before you decide, contact your benefits administrator to see whether your insurance would work with Medicare.

In general, if you have health insurance from a previous employer and retiree coverage, Medicare recommends enrolling in Part A and Part B when you’re first eligible. If you have health insurance through your or your spouse’s current employer, the guidance depends on the size of your employer. If the company has 20 or more employees, you may be able to delay enrollment without being penalized. If the company has fewer than 20 employees, you must enroll in Medicare Part A and Part B when you’re first eligible.

In addition, you should consider enrolling in Medicare Part B if your spouse’s employer requires covered dependents to enroll in Medicare when they turn 65 or if you’re not married but living in a domestic partnership, and covered by your partner’s employer health insurance. Unfortunately, these cases do not qualify you for a Special Enrollment Period where you may face late enrollment penalties.

SOURCES

- “Special Enrollment Periods.” Medicare, www.medicare.gov/basics/get-started-with-medicare/get-more-coverage/joining-a-plan/special-enrollment-periods. Accessed 12 December 2024.

- “Special Enrollment Periods.” Medicare, www.medicare.gov/basics/get-started-with-medicare/get-more-coverage/joining-a-plan/special-enrollment-periods. Accessed 12 December 2024.