Last Updated: December 30, 2024

New to Medicare? Need a refresher? We’ve got you covered. In this class, you’ll learn the basics of Medicare, including who is eligible, the different parts of the program, what each part covers (or doesn’t), and how to enroll.

Whatever your retirement plan is, chances are it will involve Medicare. After all, healthcare is one of the top expenses you’ll have during your golden years. The average 65-year-old couple today needs about $330,000 to cover their healthcare expenses during retirement.1

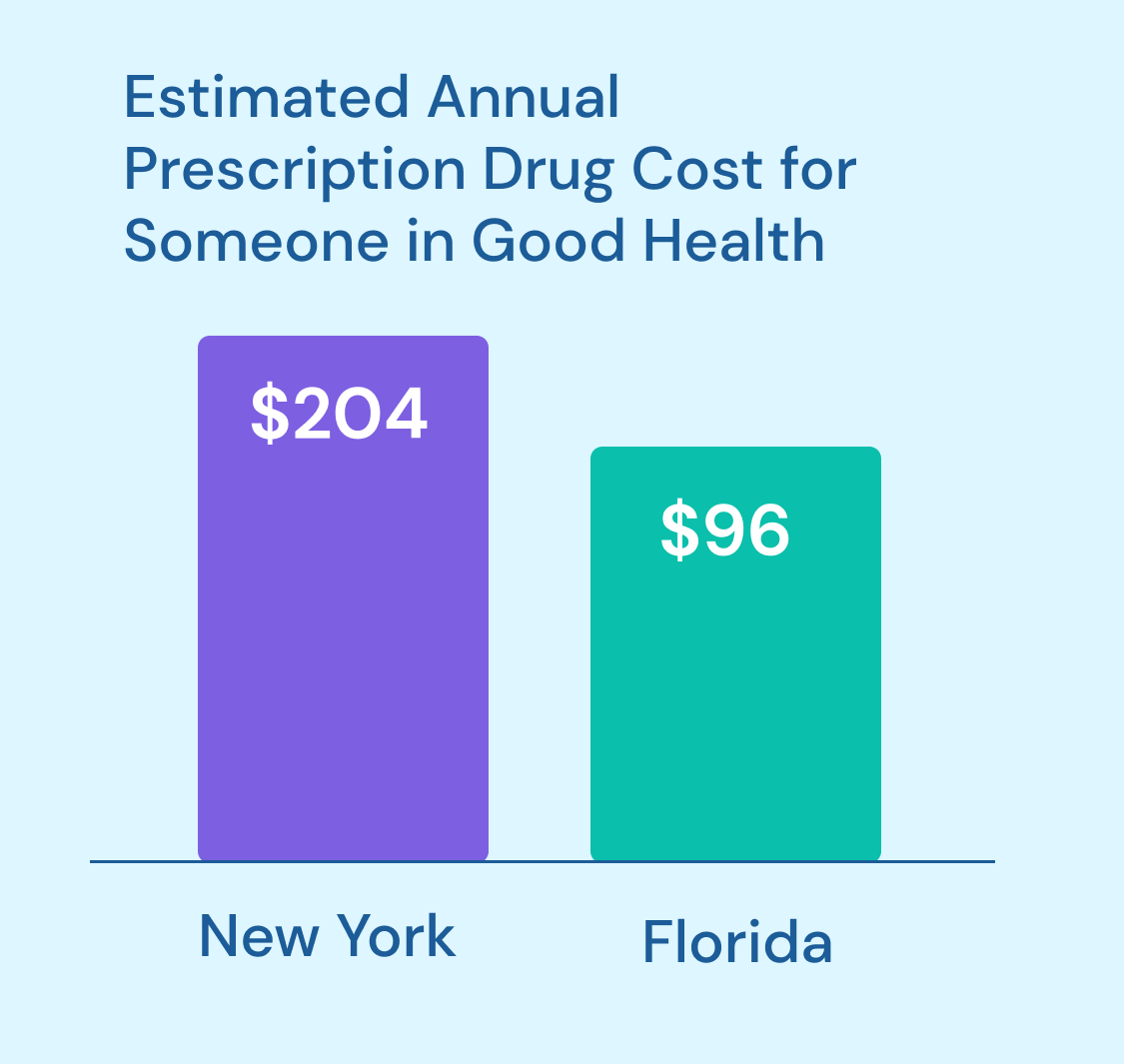

Variables like your overall health and where you live could raise or lower that amount. If you have a Medicare Advantage plan and are in good health, for example, here’s how much prescriptions drugs are estimated to cost annually in two different states:

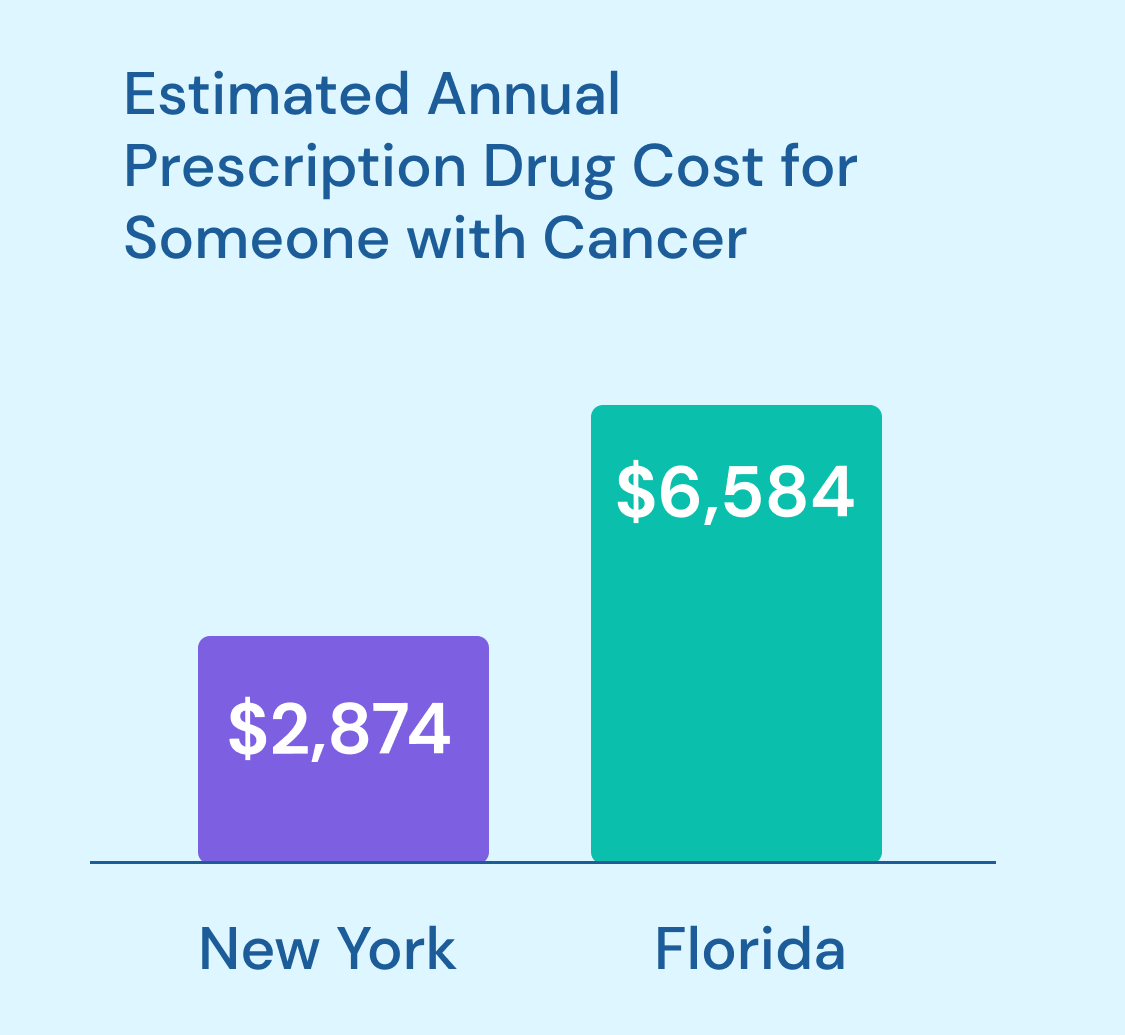

But those amounts can skyrocket when you have a chronic condition, even if you have the same coverage. Let’s say you have Stage 4 metastatic pancreatic cancer. Your annual prescription drugs could run you:

Bottom line? It pays to do your research and understand your options, so you can choose coverage that fits your lifestyle and meets your health needs. Figuring out what makes sense for you might take some time—you have several options when enrolling. But don’t worry, this class will help you navigate the process so you get the coverage that’s right for you.