Last Updated: December 19, 2024

Your fifties are the perfect time to take out an insurance policy. You’re still young and healthy, and you’re still earning money (assuming you haven’t retired already). Two types of insurance that can be crucial to any retirement period are long-term care insurance and life insurance. If you know you’ll be retiring in your early fifties, the time to initiate these policies would be your mid-forties.

Long-Term Care Insurance

The staggering cost of healthcare continues to be one of the biggest budget-busters for retirees. A 65-year-old couple retiring today should expect to spend about $330,000 on healthcare expenses over the course of their lifetime. And since you’re planning an early retirement, your bill could be even higher.

Sadly, those large figures don’t include long-term care, like time spent in a nursing home or rehabilitation facility. One year in a nursing home can cost $103,700 for a semi-private room, and an assisted living facility isn’t much cheaper, costing $59,007.1 Long-term care insurance can help offset these enormous bills, and other key services like in-home care, palliative and hospice care, and Alzheimer’s facilities, should you ever need this type of care. And there’s a good chance you might: estimates indicate about 70 percent of people over the age of 65 will require long-term care services during their lifetime.2

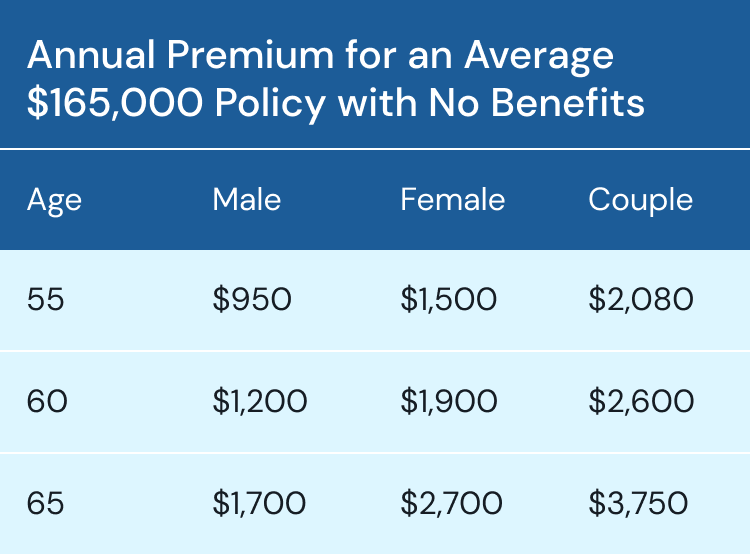

If you're hoping to retire in your fifties, you’ll want to look into obtaining a long-term care insurance policy in your forties, while you’re still working. You’ll likely have the advantage of doing well on the required health exams, but know that premiums for long-term care insurance aren’t guaranteed and do increase over time. Still, though premiums can be steep (average 2024 annual premiums for 55-year-olds are $950 for a single, man, $1,500 for a single woman, and $2,080 for a couple), they more than pay for themselves if you do need to make a claim against your long-term care policy.3

Life Insurance

Do you need life insurance in retirement? It’s a common question with a relatively simple answer: if there’s someone who depends on you for their welfare, like a disabled adult child or a younger spouse, you should have life insurance. And in some cases, such as with a permanent life plan, your life insurance policy may come with a “cash value” component that can be used as additional income in retirement. You can take a loan from the cash value portion of your policy, then pay it back over time, or simply have the amount reduced from the final payout your loved ones will receive upon your passing.4

The monthly premium for a life insurance policy can vary widely based on a number of factors, like your age, current health, smoking status and more, but estimates indicate the average monthly cost of life insurance is typically between $62 and $281 for 55-year-olds.5

The two main types of life insurance policies available to you are term life and whole life.

Whole Life Insurance

A whole life plan is a life insurance plan that lasts for your whole life. There’s no need to worry about keeping track of when your plan ends; it’s set up to end when you pass. If you opt for a whole life insurance plan, you’ll choose between a permanent plan and a universal plan.

- Whole life Permanent. With a permanent plan, your premiums stay the same each month (or year if you choose to pay your premiums annually).

- Whole life Universal. If you have a universal plan, you’ll enjoy flexible premiums that allow you to pay less or more depending on your financial situation. This type of plan requires a bit of extra discipline though; paying lower premiums for a long time sets you up for a larger bill later on, which isn’t exactly beneficial as you approach retirement.

Whole life insurance tends to be more expensive than term life because of lifelong coverage, cash value accumulation, and even potential dividends. On average, if you purchase a whole life policy in your 50s, you can expect a monthly rate of $1,045 for a $500k policy with exact rates6 depending on your policy amount, gender, and age. But you’ll notice that it's better to purchase when you’re younger to lock in a smaller monthly premium.

Term Life Insurance

Unlike whole life, term life insurance lasts for a finite amount of time. Most policies last 10 or 20 years, after which you have to sign up for a new policy or go without coverage. While term life is less expensive to purchase than whole life, keep in mind that starting a new policy becomes more expensive as you age, which is a drawback of term life insurance. That’s why, like long-term care insurance, it’s a good idea to purchase life insurance while in your fifties and still relatively healthy. On average, a healthy, 50-year-old non-smoker can expect around a $90 monthly premium for a $500,000 20-year term life policy.7

Overall, life insurance helps decrease financial burden on your family if you pass and could be used as another savings vehicle should you retire early.