Last Updated: December 19, 2024

If you’ve had a long-time goal of retiring in your early sixties before your government benefits kick in, you’re probably like 63% of all workers in the workplace who participate in a retirement plan, like a 401(k), an IRA and a pension plan.1 In this lesson, we’ll take a deeper look at the rules and regulations you’ll face when it comes to withdrawing money from your investment accounts. Here’s what you need to know as you approach retirement.

Average Retirement Savings for 60- to 64-Year-Olds

The first thing on your mind if you’re hoping to retire at 60 is likely money. And rightfully so. According to the 2022 Survey of Consumer Finances the average retirement savings in the U.S. for ages 60 to 64 is $537,560. The median retirement savings for that same age group is $185,0002 . As you can see from our example above, these numbers aren’t quite high enough to support a retirement that could still span two to two and a half decades. At these savings levels, Bob and Ellen would likely run out of money far before they stop needing it, even with their Social Security income. But, there are other factors, like equity in your home, the ability to cut back and live on less, and inheritance that could positively impact your nest egg.

Whether your savings are in line with these averages or much higher or lower, establishing a budget is a crucial first step to take before retiring. Start closely tracking your spending (aim to do this for a few months, but the longer the better!) and get familiar with where your money is going. Then, decide whether and where you can cut back if you need to. Remember to consider not only income but also things like taxes (more on that later), healthcare premiums and extras that can pop up from time to time, like car repairs or home maintenance fees.

401(k)

The average 401(k) balance for people in their sixties is $244,700.3 But the reality is that you’ll likely need much more than that if you’re going to retire between 60 and 64 and draw income for the rest of your life. The exact amount varies widely based on your individual needs.

If you’re holding on to a robust 401(k) with more than enough money to sustain your plans for an early retirement, you’ll be glad to know that at age 60, you’re finally able to make penalty-free withdrawals from your 401(k). That privilege begins at age 59 ½, and helps you avoid costly tax penalties associated with an early withdrawal from your account.

If you’ve entered your sixties feeling comfortable about the amount you have in your 401(k), give yourself a pat on the back. If, however, they fall short of these amounts, it may be to your advantage to work for a few more years in order to take advantage of catch-up contributions. The catch-up contribution limit for 401(k), 403(b), most 457 plans, and the federal government’s Thrift Savings Plan for employees ages 50-59, remains at $7,500 for 2025. New for 2025, based on changes made under the SECURE Act 2.0, a higher catch-up limit of $11,250 now applies to employees ages 60-63 who participate in these plans. The IRA catch-up contribution limit for individuals aged 50 and over remains unchanged at $1,000.4

So hanging on for just a few more years could potentially increase the balance of your 401(k) to a number that allows you to live comfortably on your investment for the rest of your life. And if you’re reading this several years before you turn 60, this is definitely something to include in your retirement plan to leave the workforce in your early sixties. Ten to fifteen years of increased contributions are sure to help boost your 401(k) balance.

IRA

Hopefully, you’ve saved additional money in an IRA if you’ve had a goal of retiring early at the age of 60. An IRA, whether Traditional or Roth, is an invaluable tool when it comes to boosting your retirement portfolio. Despite the fact that IRAs are and have always been subject to a contribution maximum, the compounding interest you could grow through decades of saving can become an invaluable asset for retirement.

When it comes to consequences for early withdrawal, your IRA functions similarly to your 401(k). By the time you reach age 60 (59 ½ to be exact), you can tap into your savings without having to worry about a penalty for early withdrawal. However, keep in mind that the money you pull from your Traditional IRA will be considered taxable income.

If you’re 60 or 61, you can contribute a maximum of $7,000 to your IRA. In another year, at 62, you can increase your contribution to $8,000. And, thanks to the SECURE Act of 2019, you can continue contributing to either IRA past the age of 72, but it must be from earned income only—not pensions, dividends, etc. Note: A spouse can make IRA contributions into their IRA account as well as their retired spouse’s IRA account as long as the total contributions do not exceed their income.

Despite the fact that IRAs are and have always been subject to a contribution maximum, the compounding interest you could grow through decades of saving can become an invaluable asset for retirement.

Roth Conversions

Do you know what your future tax rate will be once you retire? If you think it might stay the same or increase, then you should look into converting your investments into a Roth IRA to save you on taxes in your retirement. As a reminder, you’ll be subject to Required Minimum Distributions (RMDs) once you hit 73 (or 72 depending on your birth year) and by converting qualified RMD accounts like IRAs and 401(k)s into a Roth IRA, you’ll not be subject to RMDs and have tax-free withdrawals.

There’s no limit on how much money you can convert to a Roth IRA but it will increase your taxable income which could bump you into a higher tax bracket.

Here’s a tip: consider spreading your conversions over time if your income stays relatively the same year over year. This will ensure you don’t get a big tax bill by converting all at once.

Pension

If you earned a pension during your working years, it’s yet another tool that can get you closer to your goal of retiring in your early 60s. While state pensions don’t start paying out until you reach age 66, you can withdraw money from most workplace or personal pensions when you turn 55.

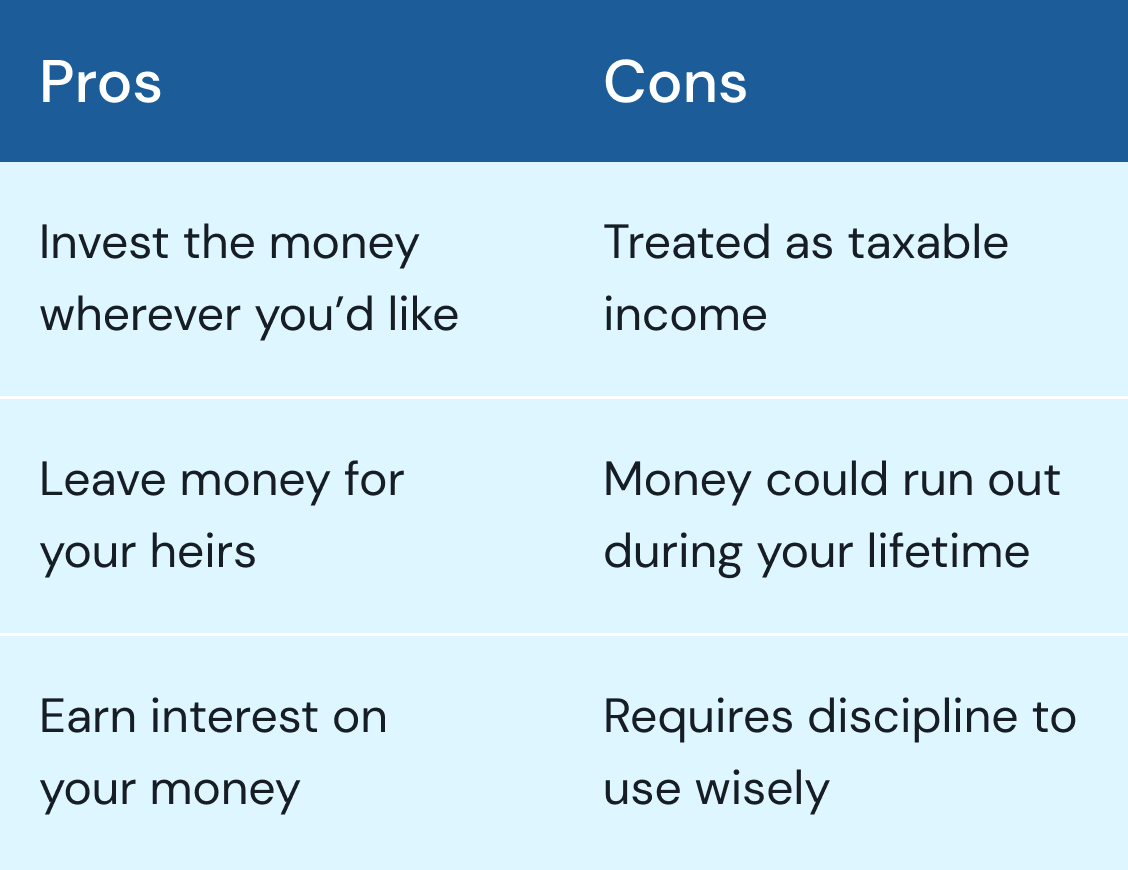

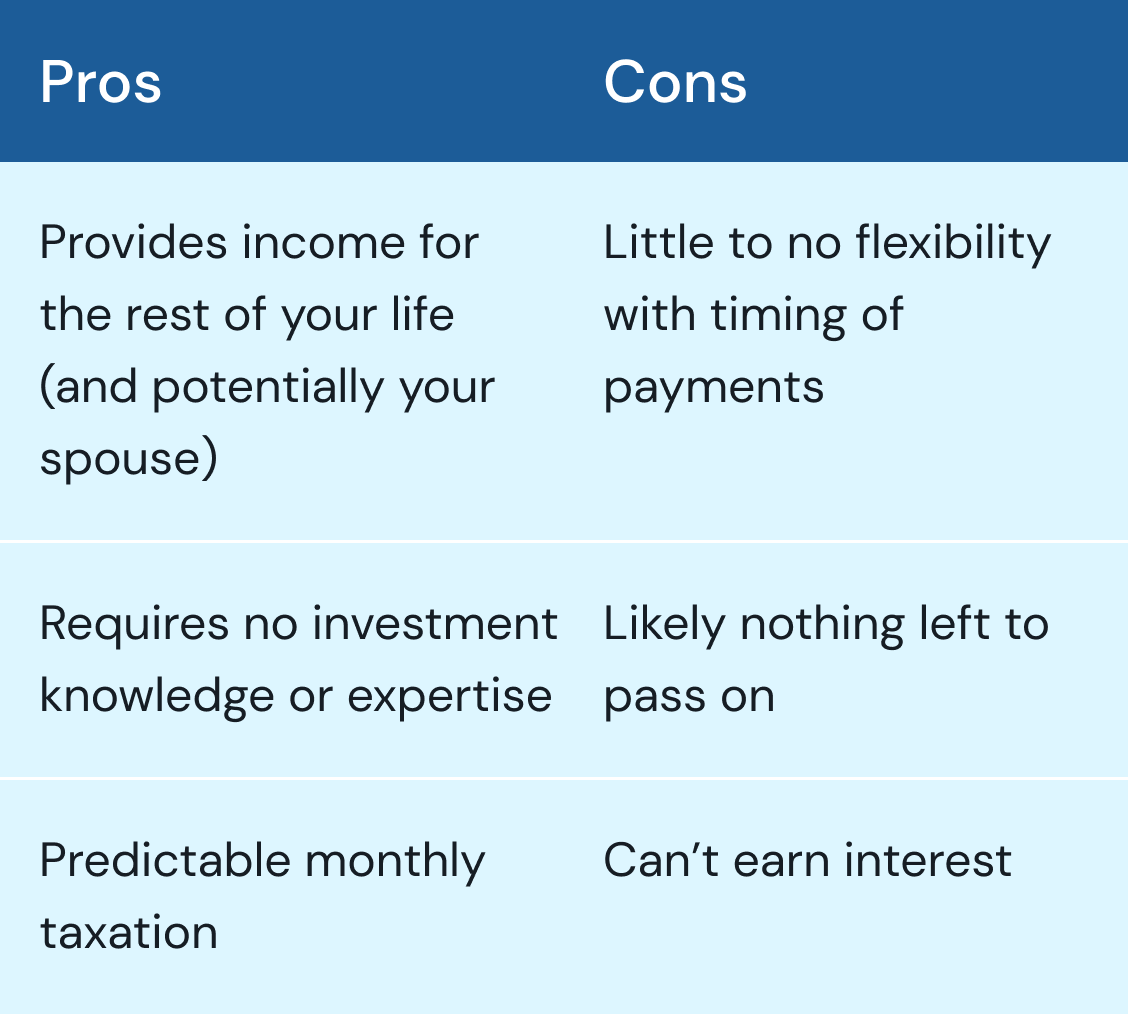

You can withdraw money from your pension as a lump sum or a monthly payout. Here are some pros and cons of each withdrawal method:5

Lump Sum

Monthly Payment

One way to support an early retirement is to take the money as a lump sum payout and invest it in an ETF or mutual fund to let it continue to grow. This strategy is best if you have experience managing your own investments.