Insurance is meant to protect you financially if a catastrophic event were to occur. And that’s exactly what you need in retirement: financial protection. Here are two types of insurance to consider for this period of your life. And your early to mid-sixties isn’t too late to start either of these.

Long-Term Care Insurance

Retiring in your early sixties should allow you many years to have fun, travel and learn new hobbies. But the fact of the matter is, there’s a chance you’ll need a nursing home or assisted living facility at some point later in your retirement. It’s understandable to not want to think about this, but now is the time to figure out a plan for how you’ll pay for that.

Estimates indicate that the average 2024 yearly cost to stay at a nursing home are upwards of $103,700. Assisted living facilities aren’t much cheaper, clocking in around $59,007.1 Luckily, long-term care insurance can help offset these high costs, covering things like in-home care, palliative, hospice care, and Alzheimer’s assistance as well.

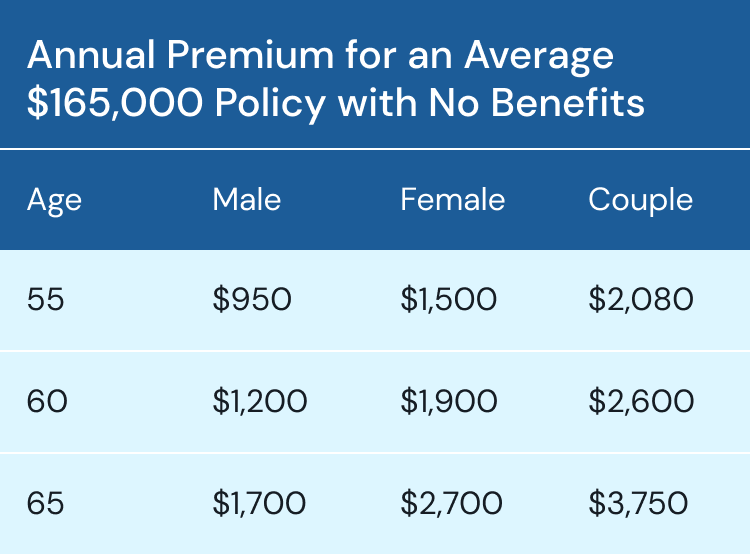

If that sounds too good to be true, that’s partly the case. The cost of long-term care insurance is quite high for a low policy without any extra coverage. Estimates for the average 2024 annual premium for 60-year-olds are $1,200 for a male and $1,900 for a female. And a couple, both age 60, can expect an annual premium of $2,600. And that’s just for a policy that would pay $165,000 without an inflation rider for long-term care expenses.2 For more coverage (which would likely be necessary), you can expect a much higher monthly premium—almost double. Additionally, if you’re hoping to have a policy that protects against inflation, you’ll need to include an inflation rider. That will increase your premiums quite a bit as well. While these policies can be pricey, it’s a short-term sacrifice to ensure you’re able to get the best care possible in the latter part of your retirement.

Life Insurance

Do you need life insurance in retirement? It’s a common question with a relatively simple answer: if there’s someone who depends on you for their welfare, like a disabled adult child or a younger spouse, you should have life insurance. And the decision to obtain life insurance shouldn’t be taken lightly, since you’ll pay more for a policy if you initiate it in your early 60s. The two main types of life insurance policies available to you are term life and whole life. Although both offer you peace of mind, one has a cheaper premium with a definite end date while the other can be used as another investment vehicle for the rest of your life at a higher monthly premium.

Whole Life Insurance

A whole life plan is a life insurance plan that lasts for your whole life. There’s no need to worry about keeping track of when your plan ends; it’s set up to end when you pass. If you opt for a whole life insurance plan, you’ll choose between a permanent plan and a universal plan.

- Whole Life Permanent. With a permanent plan, your premiums stay the same each month (or year if you choose to pay your premiums annually).

- Whole Life Universal. If you have a universal plan, you’ll enjoy flexible premiums that allow you to pay less or more depending on your financial situation. This type of plan requires a bit of extra discipline though; paying lower premiums for a long time sets you up for a larger bill later on, which isn’t exactly beneficial as you approach retirement.

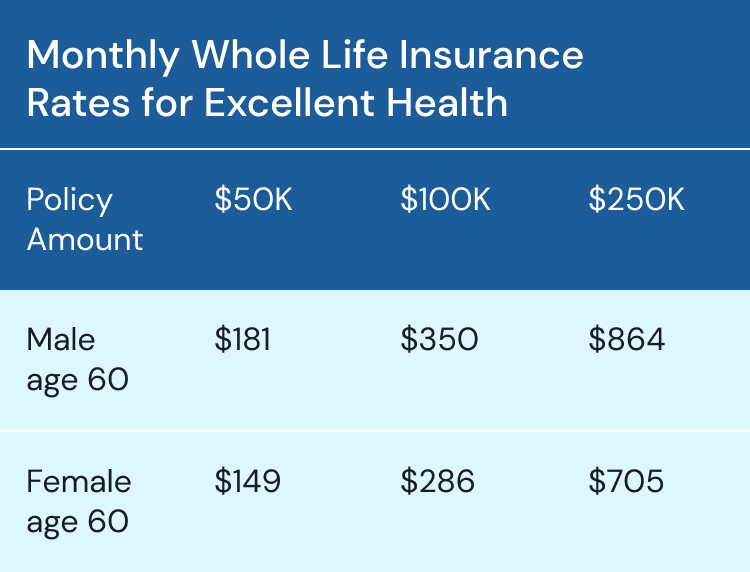

Whole life insurance is a lot more expensive than a term life policy because there are additional benefits that can be treated as another retirement savings vehicle. For example, there’s a cash value component that grows tax-free over time. So if you’ve already maxed out your traditional retirement accounts like 401(k) or IRA for the year, your whole life policy can be treated as another savings account. You can withdraw or borrow against your cash value but if you don’t repay the money, your death benefit reduces. Unlike term life, there’s a guaranteed death benefit for your beneficiaries and some policies may offer dividends.

If you’re looking to use a whole life policy for extra cash cushion, try a smaller policy. You’ll still be able to get all whole life insurance benefits at a lower premium. Policies can range anywhere from $10,000 to millions.3

Term Life Insurance

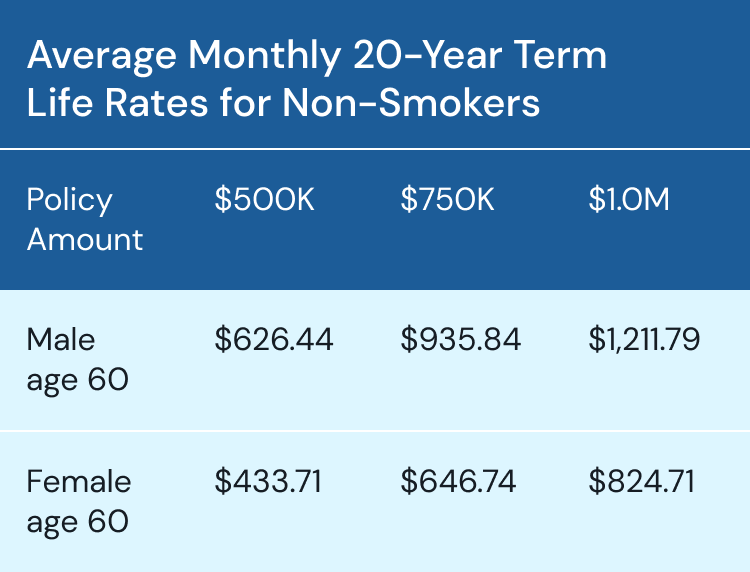

Unlike whole life, term life insurance lasts for a finite amount of time. Most policies last 10 or 20 years, after which you have to sign up for a new policy or go without coverage. And if you purchase a term life policy in your 60s, the terms available are usually only 10 or 20 years. While term life is less expensive to purchase than whole life, it doesn’t have the whole life benefits like cash value accumulation, dividends, and guaranteed death benefit. If your term life policy expires, you (and your family) don’t have access to any benefits. Keep in mind that starting a new policy becomes more expensive as you age, which is a drawback of term life insurance.4

For most, life insurance is necessary to help decrease the financial burden on your family as you pass. It provides your beneficiaries a lump sum to pay for final arrangements, any debt you’ve racked up (think loans or hospital bills), peace of mind and financial security.