Last Updated: December 19, 2024

The best way to manage your investments depends largely on the investments you have and your specific plans for retirement. However, it's important to note that being 65 and older gives you some advantages when it comes to retirement. The most notable of which is the fact you are old enough to take withdrawals from tax-advantaged retirement accounts like a 401(k) or an IRA.

However, you may want to use other assets to cover living expenses while you let your money grow, whether that includes any inheritance you have received or cash you have in a savings account. First, let’s take a look at the average savings by age for your age group.

Average Savings by Age 65 - 70

Most experts agree you can retire when you have the assets to pay for 25 years of living expenses. As an example, a 65-year-old would strive to build up assets to cover their living expenses until age 90.

So in Bob and Ellen’s case from the example in Lesson “How Long Your Savings Will Last by Budget,” if they plan to spend $75,000 per year in retirement (roughly $6,000 per month) they would be able to retire with just under $500,000 in the bank. While other retirement income streams you have can reduce the amount of money you need, longevity above and beyond that 25 years can have the opposite effect. If your family is full of octogenarians and above, Silvur can take this into account when we calculate your Retirement Score. This will give you a better sense of how long your money will last.

Once again, however, it's important to note that lowering your living expenses can help you increase your Retirement Score. If you manage to pay off your mortgage or eliminate all your debts before retirement, that can make a huge difference.

401(k)

By now, you can tap into your 401k without any concern about penalties or fees, unlike your younger peers. But one thing you will still have to pay is taxes. Since you didn’t pay taxes on the money you put into your 401k account, the tax man will be lurking when you pull money out. That’s why it’s a good idea to have a withdrawal strategy for your retirement accounts; decide which type you’ll pull from first; tax-deferred or tax free, and stick with it.

On the flip side, perhaps you’re feeling like you need to put in a few more years of work. If that’s the case because it appears your savings fall short of where they need to be, maximizing contributions to your 401k should be a top priority for you. The catch-up contribution limit for 401(k), 403(b), most 457 plans, and the federal government’s Thrift Savings Plan for employees ages 50-59, remains at $7,500 for 2025. New for 2025, based on changes made under the SECURE Act 2.0, a higher catch-up limit of $11,250 now applies to employees ages 60-63 who participate in these plans. The IRA catch-up contribution limit for individuals aged 50 and over remains unchanged at $1,000.1

IRA

By the time you reach 65 or above, you can also withdraw funds from your IRA account without penalty. If you have a Traditional IRA, you’ll be taxed on any money you withdraw, while a Roth IRA allows you to withdraw money tax free.

By this point in life, you can contribute a maximum of $8,000 to your IRA. And, thanks to the SECURE Act of 2019, you can continue contributing to your IRA past the age of 72, but there’s one caveat: you can only contribute from earned income—not pensions, dividends, or any other source. And you should know that you can contribute to both your own and your retired spouse’s IRA as long as the total contributions don’t exceed your income.2

Roth Conversions

As you enter this age bracket, 65 to 70, RMDs may be on your mind more and more if you’ve built a handsome nest egg. That’s because in just a few short years, at age 73, you’ll be required to start withdrawing a certain amount of money from your retirement accounts. Required minimum distributions can be costly, since the money you withdraw will be counted as income for tax purposes. Converting money from a tax-deferred account like a Traditional Roth or a 401k to a Roth IRA can help you avoid RMDs, but you’ll pay a hefty tax bill in the year you convert. Think of it this way: you don’t pay taxes on the money you put into your 401k or traditional Roth, so you’ll have to pay this tax bill when you convert the money from these accounts.

Doing several smaller conversions can help you avoid paying too much tax in one year. To learn more about how to account for taxes and RMDs in retirement, read our course “Taxes in Retirement 101.”

Pensions

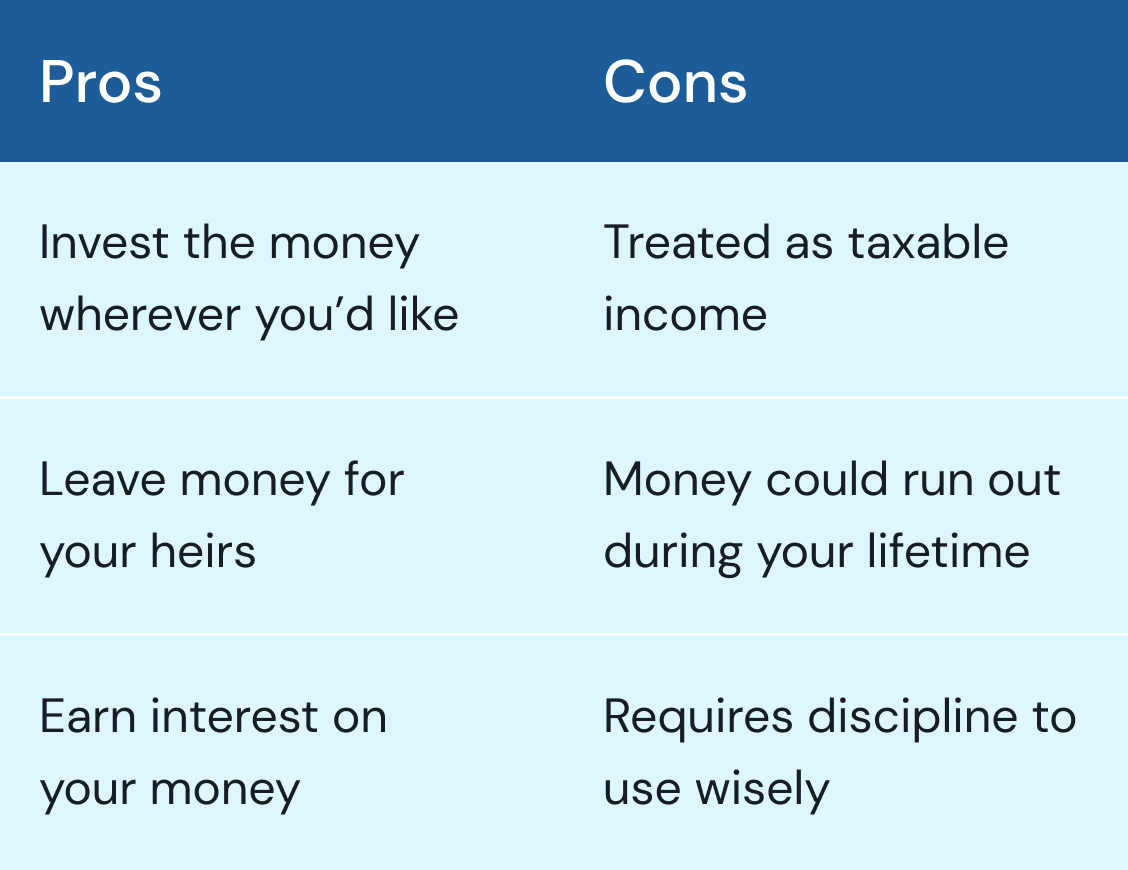

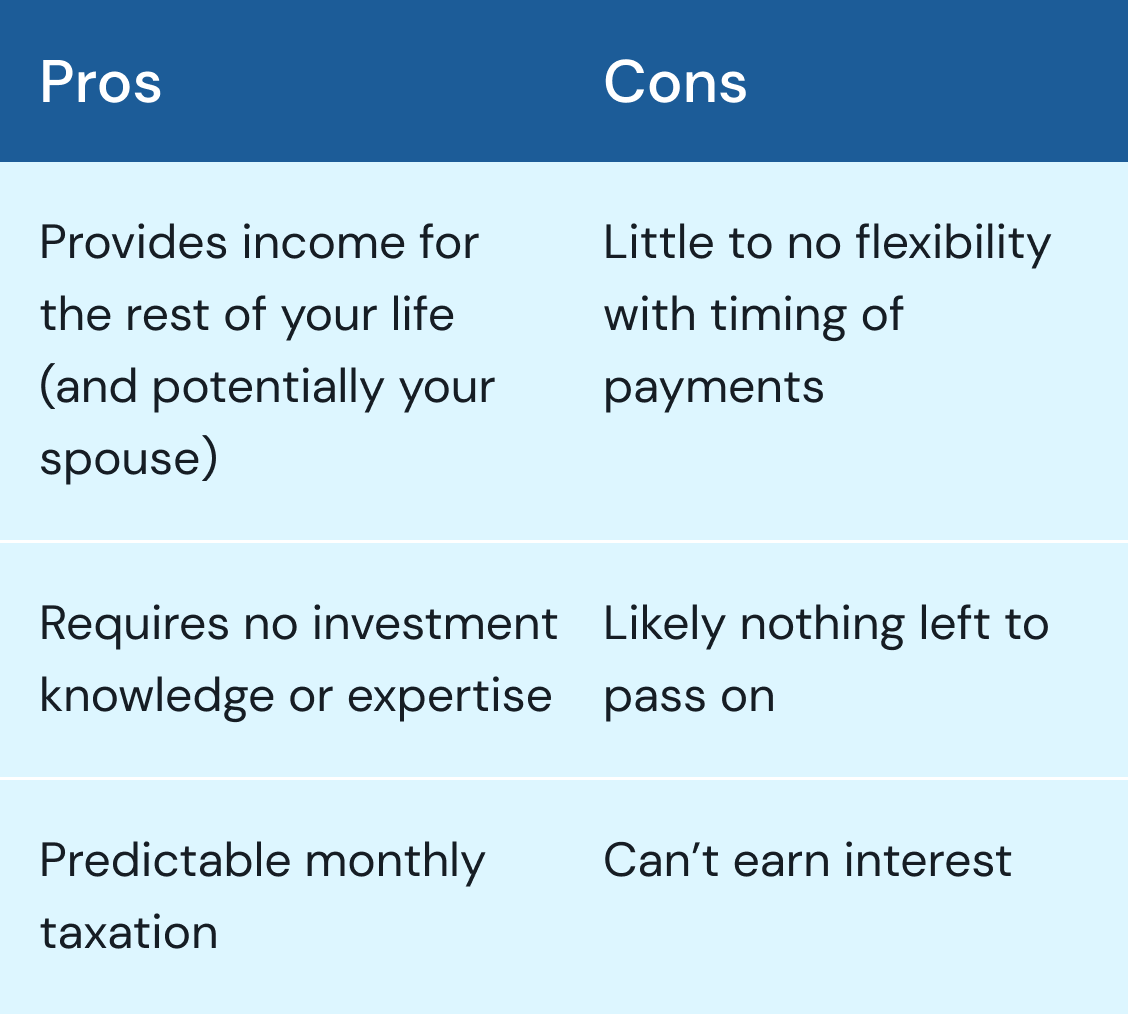

Pensions are typically offered in the form of monthly payments that last for the rest of your life. Most pension plans allow you to take a pension as a one-time lump sum payment or a monthly amount. Monthly payments can make budgeting in retirement easier, and you could end up "ahead" depending on how long you live, but a lump sum of money can give you more control over how your pension funds are invested and spent.

Here are some pros and cons of each withdrawal method:3