Last Updated: December 19, 2024

It can be difficult to determine whether or not to purchase insurance as you prepare for retirement. When you’re trying to streamline your budget, the last thing you want to do is pay for something you might not need. But there are two types of insurance that can actually bring financial security during retirement: long-term care insurance and life insurance. Here, we’ll take a look at each type so you can make an informed decision about whether these two types of insurance might be right for you.

Long-Term Care

Long-term care insurance is a type of insurance coverage that is designed to pay for the overwhelming costs of long-term healthcare, such as skilled nursing care or nursing home care. This coverage is commonly purchased with the goal of protecting financial assets. After all, the average cost of a private nursing home will be over $9,872 per month in 2024.1 Without long-term care insurance, this expense could deplete even a healthy retirement account over the span of a few years.

Most people purchase long-term care insurance between the ages of 50 and 65, even though most people never use this coverage until they're in their eighties.2 This is important to note since long-term care insurance is expensive. Buying coverage earlier in life can mean securing lower monthly premiums, but it also means you could be paying on your policy for decades before you're in a position to use it.

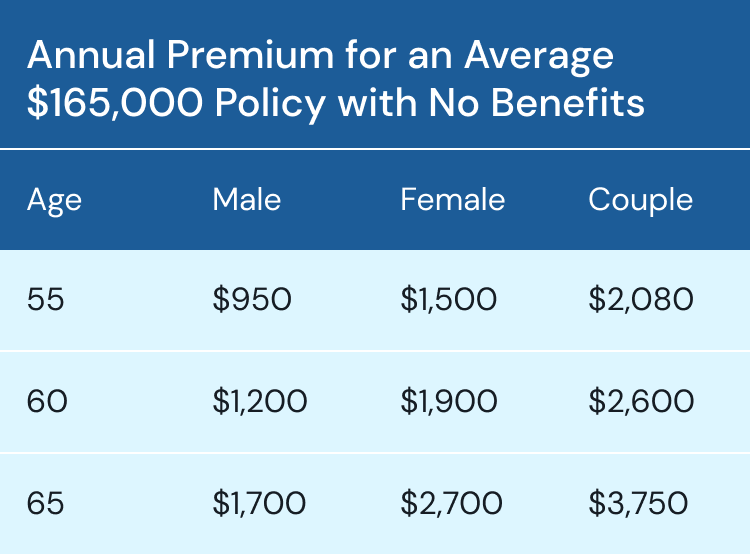

The cost of long-term care insurance is quite high for low coverage: estimates for the average 2024 annual premium for 65 year olds are $1,700 for a male and $2,700 for a female with a $165,000 policy and no inflation protection. And a couple, both age 65, can expect an annual premium of $3,750. For more coverage (which would likely be necessary), you can expect a much higher monthly premium—almost double. Additionally, if you’re hoping to have a policy that protects against inflation, you’ll need to include an inflation rider. That will increase your premiums quite a bit as well. While these policies can be pricey, it’s a short-term sacrifice to ensure you’re able to get the best care possible in the latter part of your retirement.3

On the flipside, waiting too long to purchase long-term care insurance can also leave you with limited options. Unlike health insurance that is required to accept everyone regardless of pre-existing conditions, long-term care insurance companies hand pick who is approved or denied.

Life Insurance

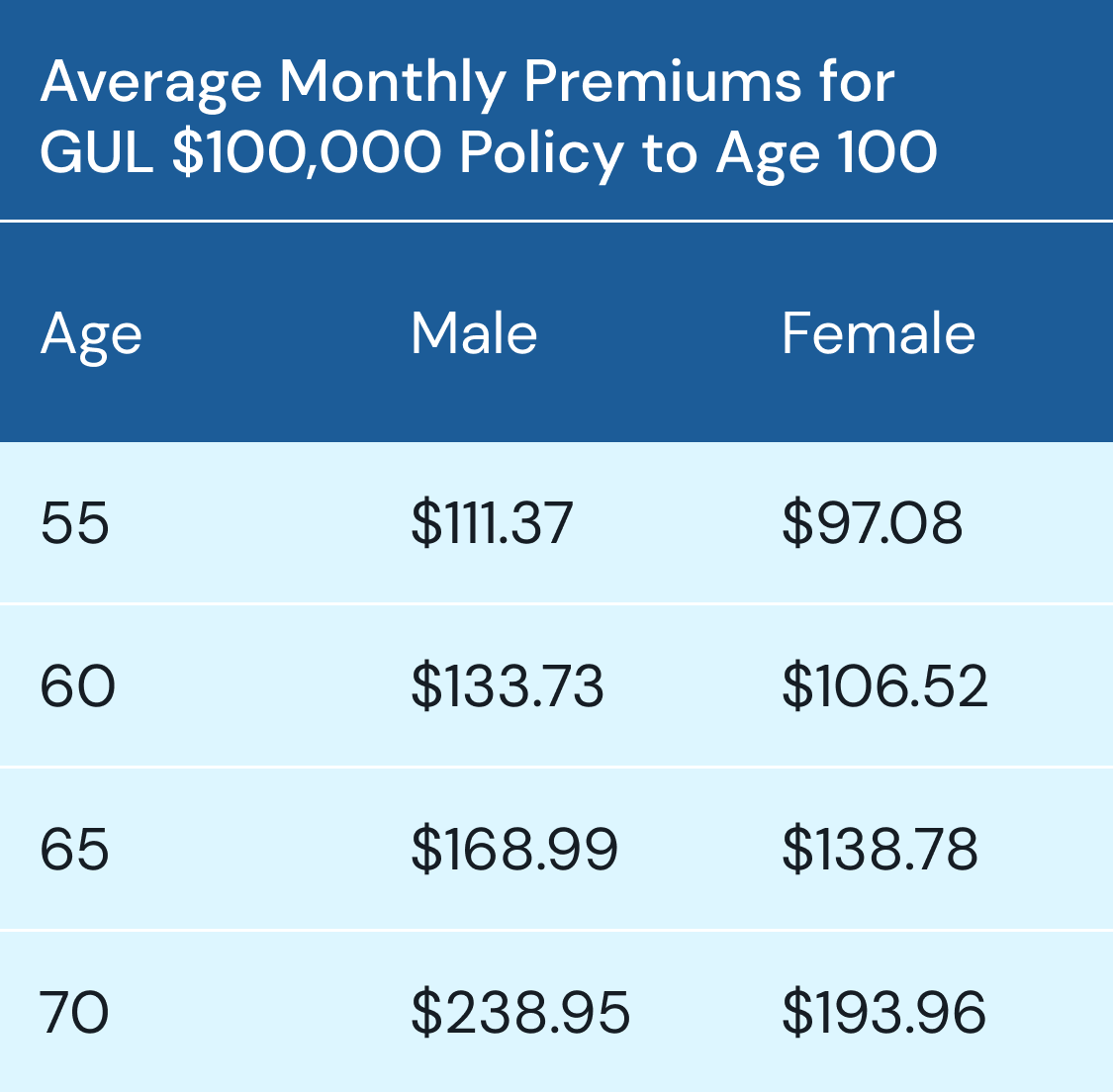

If you haven’t already purchased a life insurance policy, or your term-life policy has lapsed, you’ll want to carefully evaluate whether you need to purchase a life insurance policy at this age. Unfortunately, any policy you shop for will be quite expensive, since the chance of developing a health issue increases as you age. If you’re in your upper sixties to early seventies, Guaranteed Universal Life Insurance (referring to as GUL), is widely considered the best type of life insurance for you.

This no-frills type of coverage offers a guaranteed death benefit at the time of your passing. And since there’s no cash value offered (you can’t take a loan or withdrawal against a guaranteed universal life policy), policies tend to be far less expensive than other types, especially as you reach your older years. You can use GUL insurance to pay for final expenses, or to ensure a small nest egg for survivors, and you're guaranteed to be approved without a medical exam.4

Though this is a common strategy among retirees, at this age you would need to carefully consider whether the higher cost of permanent life policy seems like a solid strategy.